In the modern business world, the complexity of managing payroll, taxes, compliance, and employee data has made it increasingly difficult for companies to stay organized and efficient. Manual payroll processing and traditional HR management practices are no longer sufficient for today’s fast-paced and highly regulated business environment. That’s where Paycor comes in. Paycor is an all-in-one, cloud-based Human Capital Management (HCM) solution designed to streamline HR, payroll, and other business operations.

With its robust suite of services, Paycor helps businesses automate payroll, manage employee data, and ensure compliance with ever-evolving regulations. Whether you’re a small business or a large enterprise, Paycor offers the tools and features necessary to simplify your HR processes, reduce administrative burden, and ensure accuracy and compliance.

In this article, we’ll explore what Paycor is, its key features, and how it benefits businesses in managing payroll, HR, and overall workforce management.

What is Paycor?

Paycor is a cloud-based HCM platform that provides businesses with a range of solutions designed to streamline HR functions, improve payroll management, and foster better communication between employees and employers. Paycor is specifically tailored to serve small and medium-sized businesses (SMBs), although its scalability allows larger organizations to take advantage of its services as well.

Founded in 1990, Paycor has built a reputation for offering comprehensive HR and payroll solutions that reduce administrative time and improve overall workforce efficiency. The platform is designed to handle payroll, benefits, time and attendance tracking, performance management, talent acquisition, and employee data management, among other HR-related functions. Paycor’s core services are organized into different modules that allow businesses to choose the specific tools they need to support their operations.

Key Features of Paycor

Paycor is packed with a wide variety of features to help businesses manage payroll, track employee data, and automate HR tasks. Below are some of the most valuable and impactful features of Paycor:

1. Payroll Processing

At the heart of Paycor’s offerings is its payroll management system. Paycor automates payroll processing to ensure employees are paid on time and accurately. The system calculates employee wages, including regular pay, overtime, bonuses, and deductions, while also managing tax calculations.

For companies with a multi-state presence, Paycor simplifies the process by automatically calculating and withholding the appropriate state, federal, and local taxes based on an employee’s location. The platform supports direct deposit and can generate detailed pay stubs for employees to view and download.

In addition to handling pay calculations, Paycor also handles year-end tax filing, including the creation of W-2 and 1099 forms, helping businesses comply with federal and state tax laws.

2. Employee Self-Service Portal

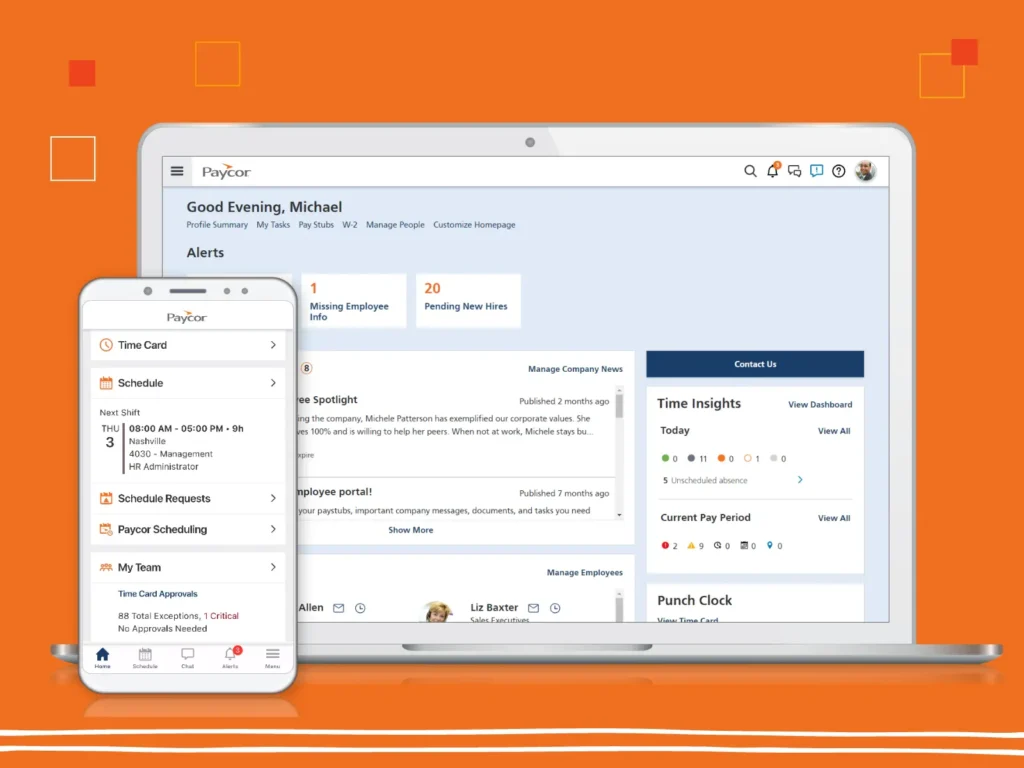

One of the standout features of Paycor is its employee self-service portal. This portal empowers employees to access their payroll and benefits information on-demand, improving transparency and communication between employees and HR departments.

Through the portal, employees can view their pay stubs, download tax forms, and update personal information, such as direct deposit details or tax withholding preferences. This reduces the need for HR teams to handle routine payroll inquiries, freeing up time for more strategic tasks. Additionally, employees can track their benefits selections, manage paid time off (PTO), and request time off through the self-service platform.

3. Tax Filing and Compliance

One of the most challenging aspects of payroll management is ensuring compliance with changing tax laws. Paycor simplifies tax compliance by automatically calculating federal, state, and local taxes for each employee. It helps businesses navigate complex tax regulations and ensures that taxes are withheld accurately.

Moreover, Paycor handles the filing of quarterly and year-end tax returns, such as Form 941, and generates the necessary tax forms, such as W-2s and 1099s, to distribute to employees. Paycor ensures that all required tax forms are filed on time, helping businesses avoid costly penalties and maintain compliance.

4. Time and Attendance Tracking

Another critical feature of Paycor is its integrated time and attendance module. This module allows businesses to track employee work hours, including regular hours, overtime, and absences, all in one system. Employees can clock in and out through their mobile devices or on-site time clocks, and Paycor automatically records this data, calculating work hours based on company rules and pay schedules.

The time and attendance module also helps businesses manage paid time off (PTO), including vacation days, sick leave, and other types of leave. HR managers and business owners can easily track leave balances and request approvals, streamlining the entire process.

5. Benefits Administration

Paycor offers a comprehensive benefits administration solution that enables businesses to manage employee benefits, including health insurance, retirement plans, and other voluntary benefits. The system allows employees to enroll in benefits, make changes during open enrollment, and view their benefits selections in real-time.

For HR teams, Paycor automates benefits tracking and integrates benefits data directly into payroll processing. This ensures that deductions are applied correctly and that businesses remain compliant with benefits regulations.

6. Recruiting and Onboarding

In addition to payroll and HR management, Paycor offers a suite of tools for recruiting and onboarding employees. The recruiting module helps businesses post job openings, manage candidates, and track the hiring process from start to finish. Paycor’s applicant tracking system (ATS) makes it easy for hiring managers to evaluate resumes, schedule interviews, and make offers to the best candidates.

Once a candidate is hired, Paycor’s onboarding features allow businesses to automate new employee paperwork, including tax forms, benefits enrollment, and other necessary documentation. This ensures a smooth transition for new hires and accelerates their integration into the company.

7. Performance Management

Paycor includes performance management tools to help businesses track employee performance and align individual goals with overall company objectives. Managers can set goals, conduct performance reviews, and provide real-time feedback through the platform. This feature enhances communication between employees and their managers, leading to higher engagement and productivity.

The platform also enables businesses to track employee development, training progress, and skill-building initiatives, helping to foster a culture of continuous learning.

8. Reporting and Analytics

Paycor offers robust reporting and analytics tools that allow businesses to gain insights into their workforce and payroll data. The platform provides real-time data on employee performance, labor costs, and other HR metrics.

The reporting module enables HR teams and business owners to generate custom reports, track KPIs (key performance indicators), and identify trends in employee turnover, performance, and compensation. These insights can help businesses make informed decisions, optimize labor costs, and improve employee retention.

Benefits of Using Paycor

Implementing Paycor as your business’s payroll and HR solution comes with numerous benefits, including:

1. Time Savings and Efficiency

By automating payroll processing, tax filing, benefits administration, and time tracking, Paycor helps businesses save significant time. With streamlined workflows and data integration across multiple HR functions, businesses can reduce administrative tasks and focus on strategic initiatives like growth and employee engagement.

2. Improved Accuracy

Manual payroll processing is prone to human error, leading to mistakes in employee pay, tax calculations, and benefits deductions. Paycor minimizes these risks by automating key tasks and providing real-time updates on changes to tax laws and regulations. This ensures that businesses remain compliant and that employees are paid accurately.

3. Compliance Assurance

Staying compliant with labor laws, tax regulations, and benefits rules is a significant challenge for businesses. Paycor helps businesses navigate these complexities by ensuring tax calculations and filings are accurate and timely. The system automatically updates based on changing laws, helping businesses avoid penalties and audits.

4. Employee Satisfaction

Paycor’s self-service portal and accurate payroll processing improve employee satisfaction by providing employees with easy access to their pay and benefits information. With the ability to track time, request time off, and manage benefits independently, employees have more control over their data, leading to a better employee experience.

5. Scalability

Paycor’s platform is scalable, meaning it can grow with your business. Whether you’re a small business looking for basic payroll functionality or a larger organization needing advanced HR features, Paycor can be customized to meet your specific needs. As your workforce expands or your business enters new markets, Paycor can adapt to your changing requirements.

Conclusion

Paycor offers a comprehensive suite of tools designed to simplify payroll, HR, and workforce management. From payroll processing and tax filing to employee performance tracking and recruiting, Paycor integrates all the key functions necessary for effective HR management into one cloud-based platform. The platform’s automation capabilities, tax compliance features, and intuitive employee self-service tools make it an ideal solution for businesses of all sizes looking to streamline their operations, reduce administrative costs, and ensure payroll accuracy.

Whether you’re managing a small team or running a large enterprise, Paycor’s payroll and HR solutions provide the flexibility, accuracy, and scalability needed to manage your workforce efficiently. By leveraging Paycor, businesses can focus on what matters most—growing their business and enhancing the employee experience.